Global blueberry market 2025: Africa’s rising influence

- . November 2025

IBO delegate Gustavo Yentzen shared at the Morocco Berry Conference 2025 in Agadir how the global blueberry industry keeps expanding.

Rising production, improving yields, persistently high prices, and growing consumer demand inclusive with Africa are the main factors depicted in Agadir the past November 13th to the leaders of the Morocco berry industry. According to Gustavo Yentzen from the International Blueberry Organization (IBO) those key structural shifts will continue to shape the industry through 2030.

3,2 million tons production by 2028, 49% increase

Global planted area and output continue to expand. In 2024, the world produced 2.15 million tonnes of blueberries (fresh and processed), with 78% destined for the fresh market and 22% for processing. Although plantings keep increasing, 17% of global hectares are not yet in commercial production, suggesting further growth ahead. By 2028, total production is projected to reach 3.2 million tonnes, a 49% increase, with every region contributing to expansion. Improving genetics and horticultural practices have pushed global yields up to 9,190 kg/ha, with the Americas now leading in productivity, followed by EMEA and Asia-Pacific.

10 countries dominate the market

The industry remains highly concentrated: the top 10 producing countries account for nearly 90% of global volume. The top 10 import markets represent 85% of global cross-border trade. The American continent, while still dominant, have for the third consecutive year produced less than 50% of the world’s blueberries, reflecting rapid expansion elsewhere.

Prices remain historically high but stabilizing

Despite volatile supply conditions, notably delayed Peruvian shipments, global blueberry prices stayed among the highest of the past decade, averaging just under $7/kg. Demand still grew faster than imports in 2024, signaling stronger consumer appetite for blueberries worldwide.

Africa: the next global growth engine

Africa is emerging as a strategic region for blueberry expansion. It counts now with 3,719ha of planted area, with a 376% increase over the past 10 years. While still smaller than traditional producers, African origins are scaling rapidly thanks to available land, competitive labor, climate advantages and rising investment. Africa produces 49,300 tonnes (including South Africa, Zimbabwe, Zambia, Kenya and Namibia), mostly for the fresh export market (90%). Western and Central Europe are the primary destinations. The continent also started supplying the fast-growing demand in Asia and the Middle East. At country-level, South Africa with 2,803ha is an established exporter with growing professionalism; Zimbabwe with 710ha shows now a strong expansion trend; Zambia (100ha) has a better agronomy and potential, it also enjoys access to China market via South African logistics; Kenya (50ha) has near year-round production potential and increases trial fields, new plantings; Namibia has smaller but specialized projects, now embraced with renewing genetics. A common characteristic is the industry’s ability to create jobs, a key competitive advantage as other regions face labor shortages.

Morocco the Africa’s powerhouse and Europe’s winter supplier

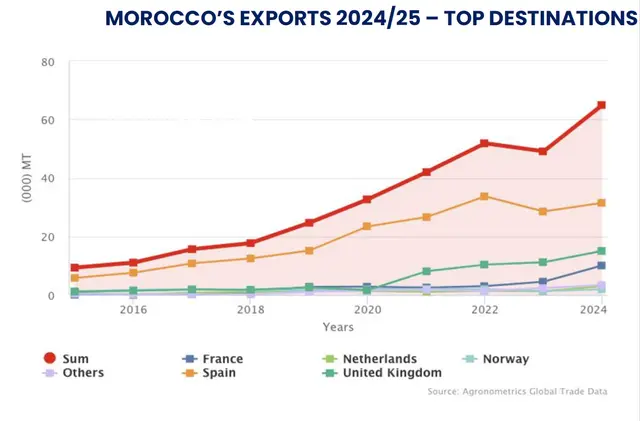

Morocco stands out as one of the world’s most dynamic producers: production has increased over 400% in recent years. 71,700 tonnes of fresh blueberries were produced in 2024. Yields reached a remarkable 18,343 kg/ha. Nearly 95% of Moroccan blueberries are exported, mainly to Europe, with growing interest from China and other Asian markets. Morocco is expected to reinforce its role as Europe’s key winter–spring supplier. Expansion areas include Agadir and Dakhla, particularly for early-season fruit. Increasing use of proprietary genetics will push quality higher.

11-21-2025

Source: Fructidor.com