Ambitions for Sustainable Blueberry Growth: Spain’s Strategy in Huelva

Spain’s prominence in the blueberry sector can be attributed to a confluence of favorable factors, with the province of Huelva playing a central role. The region’s climatic conditions, soil quality, and meticulous selection of plants have collectively provided an optimal environment for blueberry cultivation. Furthermore, the adaptability of blueberry cultivation to production methodologies used in other berries, such as strawberries and raspberries, has further facilitated the industry’s growth and resilience.

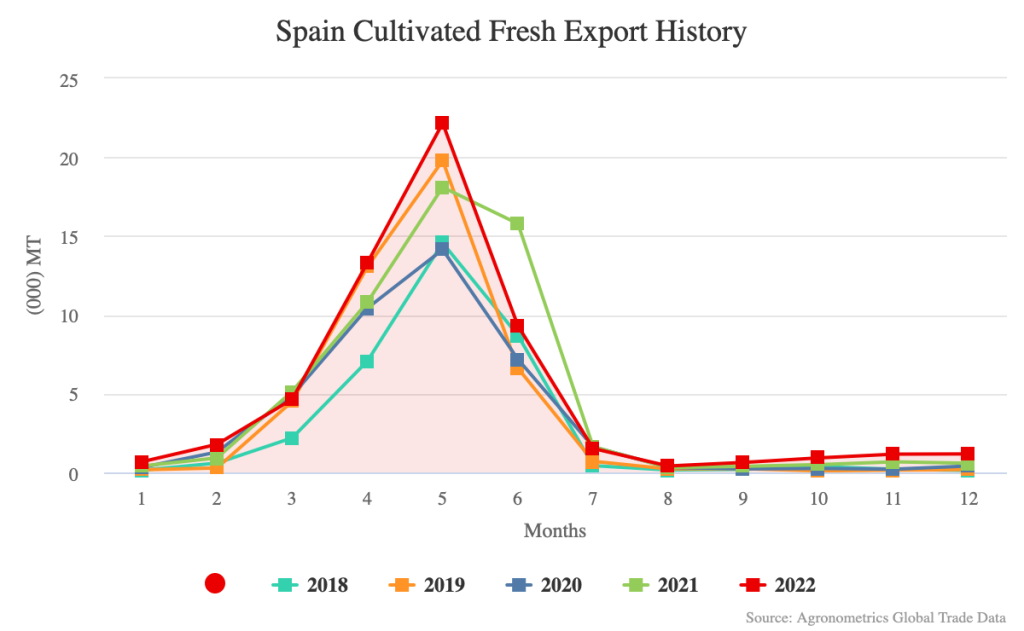

A key factor contributing to Spain’s success in the blueberry market is its ability to distribute production across various months, avoiding dramatic spikes. With a production span of over six months, coinciding with the strawberry and raspberry campaigns in Huelva, Spain has successfully penetrated established European markets, including Germany, France, and the Netherlands. This staggered production approach has not only ensured consistent market supply but has also facilitated entry into markets already familiar with other berries.

Huelva saw a delayed onset of low temperatures in the 2023 season, preventing the accumulation of sufficient cold hours during the winter. A cold spell in the last weeks of February and early March resulted in reduced calibers. Additionally, the reduced availability of water for irrigation impacted crop development.

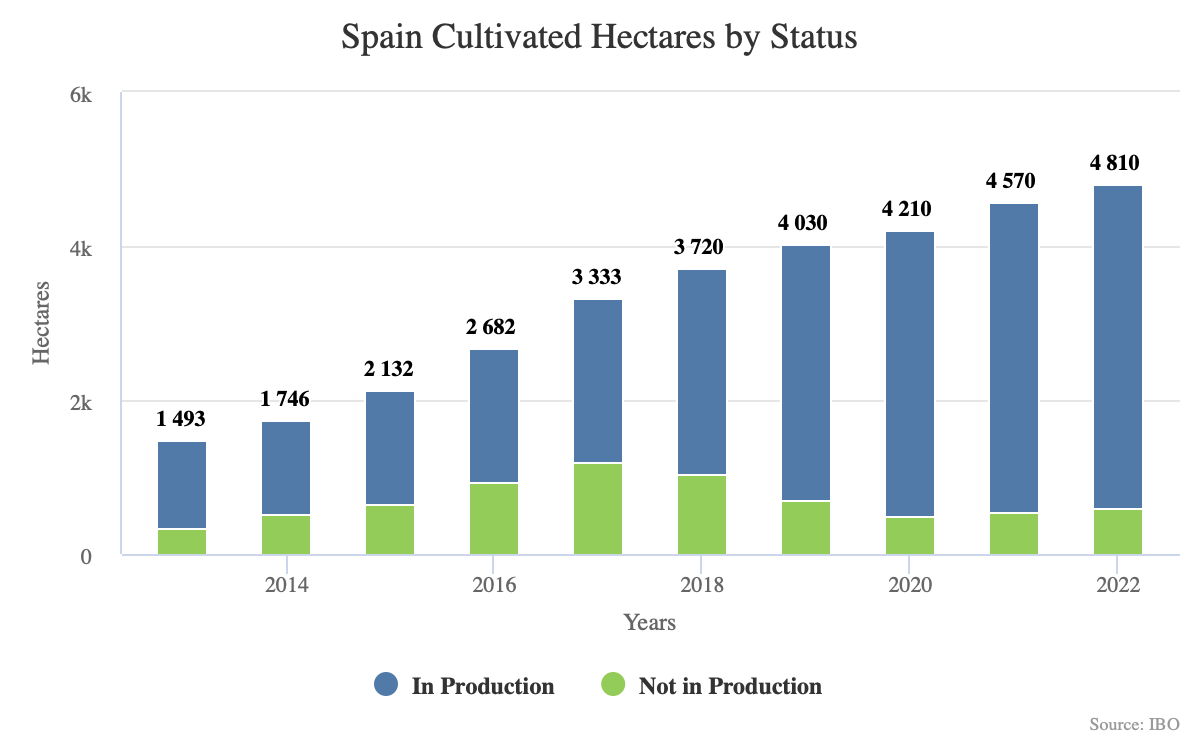

Freshuelva reported a marginal uptick in the blueberry cultivation area, with a modest 0.5% increase from 3,602 hectares in the 2022 season to 3,610 in the 2023 one. “Blueberries have consolidated their position as the second most widely planted berry in our province behind strawberries, despite the fact that they also face significant competition from third countries, particularly during the spring months,” the organization says.

Several sources in the industry suggest that production in 2024 will be slightly higher than last year’s. Stakeholders are optimistic about achieving climatic stability throughout the production cycle in the 2024 season, maintaining market stability in destination countries, increasing domestic blueberry consumption, and, ultimately, sustaining profitability across the entire production process. These goals highlight the industry’s commitment to not only meet current demands but also to secure a financially viable future.

In response to the changing dynamics in the global blueberry market, notably with the emergence of new players such as Morocco, industry leaders are strategically focused on maintaining competitiveness. “The primary strategy involves a steadfast commitment to consistently producing high-quality blueberries and ensuring the alimentary safety of the product,” says Mamen Mingorance of Freshuelva’s Technical Department. This approach is seen as crucial in navigating the challenges posed by evolving competition and meeting the discerning expectations of the market.

Significant strides are being made in the realm of varietal renewal, underlining the industry’s dedication to Research and Development (R&D). Producers are actively investing in proprietary varietal programs tailored to the unique conditions of Huelva. Simultaneously, private entities specializing in varietal development contribute to enhancing the adaptability of blueberry varieties to the region. This forward-looking approach positions the industry to not only meet current market demands but also to adapt to changing preferences and environmental conditions.

Despite the industry’s successes, several challenges loom on the horizon. Climate change, impacting water availability and temperature extremes, poses a significant threat. Labor shortages, limited availability of phytosanitary tools for pest and disease control, and elevated production costs collectively contribute to the complex landscape in which the industry operates. Navigating these challenges will require innovative and adaptive strategies to maintain profitability.

On February 1, 2024, the agricultural associations of the province of Huelva, including Freshuelva, spearheaded a demonstration in Seville, Spain, emphasizing the urgent need for committed hydraulic infrastructures. This mobilization received extensive support and participation from various sectors, underscoring the significance of this cause for the entire province. The unified advocacy for hydraulic infrastructures reflects the shared commitment of these associations towards sustainability.

The rise in blueberry consumption within Spain can be attributed to comprehensive marketing and advertising campaigns. Organizations such as Freshuelva, along with individual producers, have played a pivotal role in highlighting the nutritional qualities, organoleptic attributes, and numerous health benefits of blueberries. While these efforts have yielded positive results, ongoing initiatives are imperative to further boost domestic consumption and cultivate a sustained interest in blueberries among Spain’s population.

To meet the growing demand for blueberries, industry efforts are concentrated on maintaining product quality, ensuring food safety, and exploring new packaging forms. These initiatives are essential not only to address current market demands but also to stay ahead of evolving consumer preferences and market trends.

Spain predominantly exports blueberries to the EU and the UK, with ongoing efforts to expand market reach. Recent successes in opening markets in Brazil and Canada showcase the industry’s commitment to diversifying its export destinations. Collaborative efforts between the industry and government authorities play a pivotal role in navigating export protocols and agreements, ensuring a smooth and expanding international market presence.

Short and medium-term strategies are focused on continual improvement and adaptation to changing circumstances. Industry stakeholders are committed to enhancing campaign outcomes while striving to maintain the profitability of blueberry productions. The collective vision encompasses not only addressing current challenges but also positioning the industry for sustained growth and resilience in the dynamic global blueberry market.

International Blueberry Organization

International Blueberry Organization

The charts and content presented in the story was build by Agronometrics and the work published in the IBO’s 2023 Global State of the Blueberry Industry Report.

For more information you can download the entire report for free at: