Colombia’s growing blueberry industry: record imports and expansion of high-altitude crops

- . September 2025

With a developing industry, Colombia is making steady progress in the blueberry industry. The sharp increase in imports to meet domestic demand, the start of record exports, and high-altitude plantations driven by international investors are shaping the country as an emerging competitor with significant potential in key markets such as the United States, Europe, and Asia.

Colombia is beginning to gain ground in the global blueberry industry, and several factors show that the country has significant potential to become a major competitor. Its proximity to the United States, its unique history of local consumption, and its capacity to produce almost year-round position it as an emerging industry.

Colombia’s recent success in exporting other fruit crops such as avocados, lemons, and flowers, along with its efficient operating and logistics models in the competitive cut flower industry, demonstrates that the country has the experience and the necessary conditions to replicate this performance in the blueberry industry.

Growth in domestic consumption

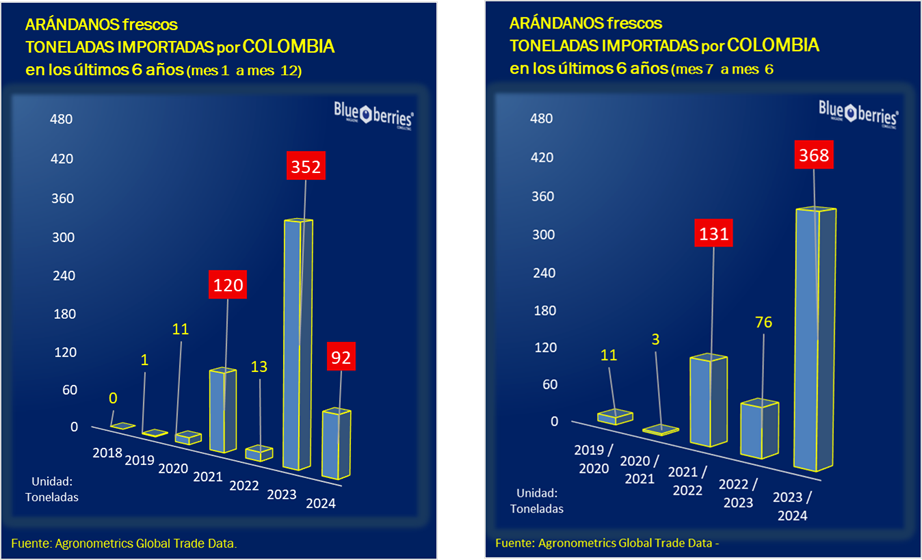

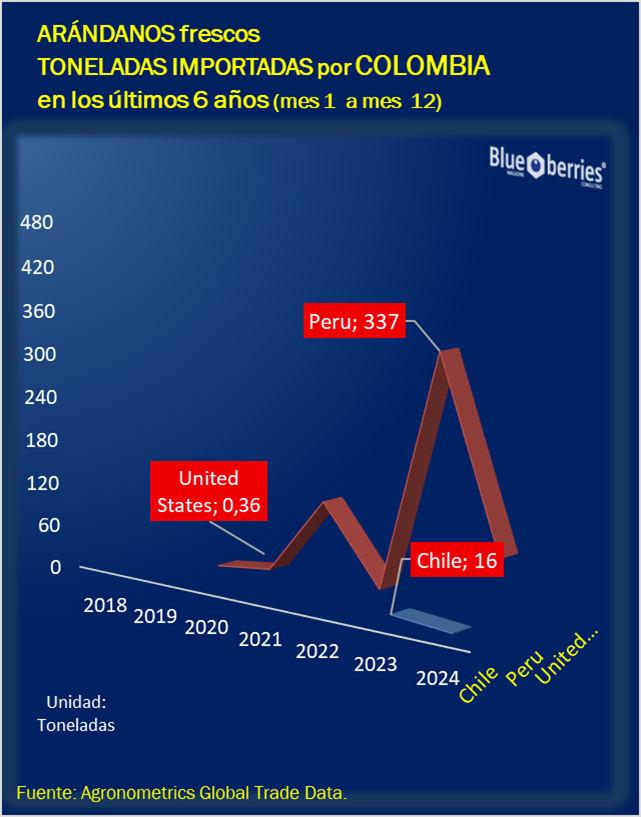

Although Colombian blueberry exports have not yet shown sustained growth, domestic demand has grown exponentially. In 2023, fresh blueberry imports increased 29-fold compared to the previous year, reaching 352 metric tons, mostly from Peru and, to a lesser extent, Chile.

The imbalance between production and domestic demand is due to the fact that supply is unable to keep up with the pace of growing domestic demand and the slow rate of new plantations.

In 2023, blueberry imports soared compared to 2021, a year that until then had set record highs, with domestic consumption practically tripling.

Furthermore, in the first two months of 2024, imports grew by 136%, reaching 130 metric tons, a volume that in just a few weeks surpassed the total imported in all of 2021.

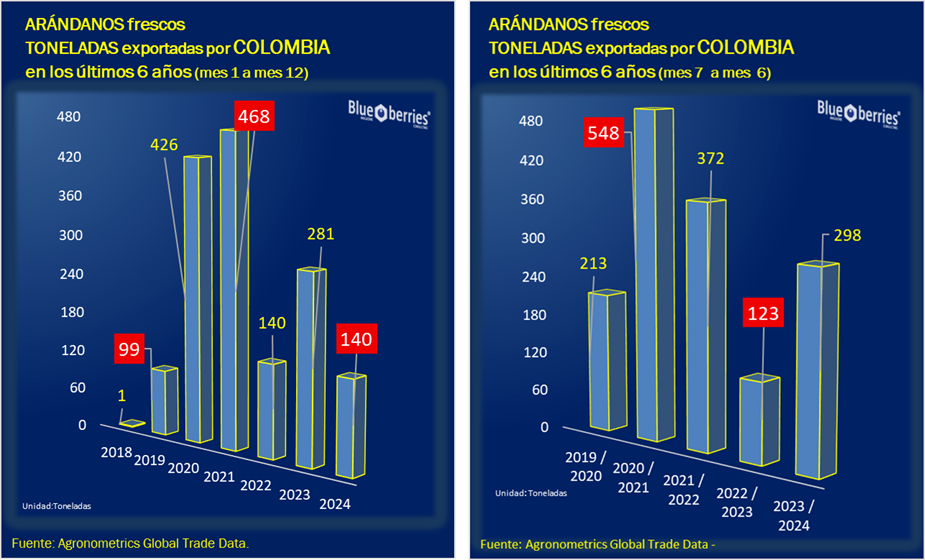

Exports also grow

This growth is even more significant because it occurred immediately after the peak production months (November and December). In January 2024, Colombia exported 99 metric tons, a historic record for that month and just shy of the 100 tons reached in December 2020, one of the country’s highest monthly records.

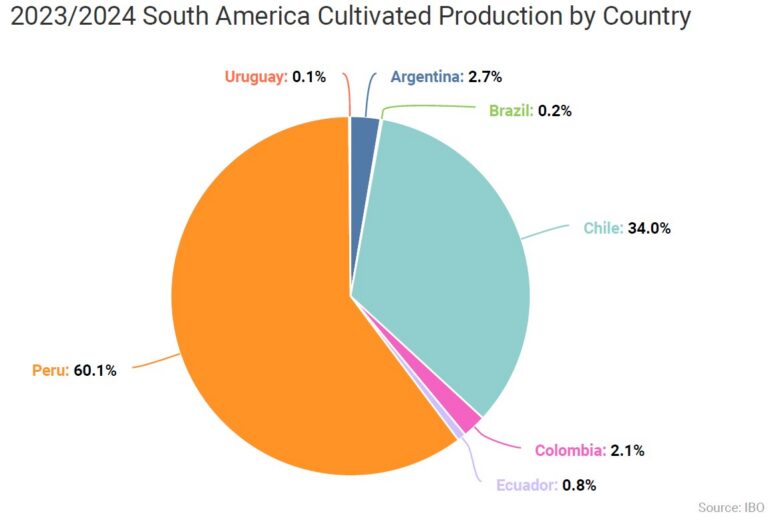

While these figures are not yet significant globally, they are higher than those of Argentina, which has shown a downward trend in its blueberry exports over the last decade.

Domestic consumption is increasing significantly. Although most Colombians purchase blueberries in open markets, where lower-quality varieties predominate, more and more supermarkets are introducing and selling premium blueberries.

“I’m seeing differentiation in Colombia and also in Ecuador. Supermarkets are now willing to pay for a higher-quality product, something I’ve never seen before,” said an industry source.

Nearly 95% of the country’s blueberry production remains in the country, primarily for fresh consumption. However, the industrial processing market is growing, with more and more foods incorporating blueberries as an ingredient.

Export prospects

Colombia’s export prospects depend largely on the implementation of a systems approach to its main market: the United States. In this regard, some producers are being monitored and tested to meet this ambition. Currently, the available alternatives, according to the protocol for shipment to the United States, are methyl bromide treatment upon arrival—unwanted—or a 14-day cold treatment in transit.

In 2023, there was a breakthrough, as industry representatives reported that the United States approved the systems approach, the implementation of which would take about two years. This would reduce shipping times to just seven days from harvest to Florida ports. However, Colombia’s high domestic transportation costs, combined with ocean freight, narrow the cost gap with air freight, unlike what occurs in other producing regions.

In 2023, Colombia gained access to the Canadian market, with the first test shipments in early 2024. There is also emerging diversification into non-traditional markets such as Thailand, Saudi Arabia, Panama, and Curaçao.

Lack of varieties, an obstacle to overcome

One of the main obstacles facing the Colombian industry is the limited availability of plant material, especially proprietary varieties. Currently, the Biloxi variety predominates, followed by Emerald, Legacy, and Victoria, cultivars that are losing favor among international retailers. Although producers are eager to access new genetics, nurseries face long delays in the delivery of material.

Companies linked to large blueberry companies or breeders in the US, Chile, Spain, and Australia produce limited volumes of proprietary genetic varieties, where they also conduct trials. Fewer than 30 hectares of new blueberry plantations were established last year, mostly with open varieties such as Emerald and Legacy, although an increase in orders from nurseries is projected over the next 12 months.

High altitude tropical blueberries

Unlike Peru, whose development relied on coastal genetic varieties with low chill requirements, in Colombia, international companies from Chile, the United States, and others have opted for plantations between 2.600 and 3.000 meters above sea level, under the concept of “high-altitude tropical blueberries.”

The Colombian cultivation system resembles the non-chill perennial production of central Mexico, but without a defined seasonal pattern. Currently, three production peaks are recorded: the first and highest in November-December, followed by May-June and September. Most plantations are located in the mountainous plains of Boyacá and Cundinamarca, north of the Colombian capital, Bogotá, where the narrow difference in daylight hours throughout the year allows pruning to be managed to induce production according to the needs of each farm.

Challenges and expansion of the industry

Production in these areas presents several challenges: farmers face cold, rainy nights followed by warm days. Open-field cultivation remains the predominant system for most crops in Colombia, including blueberries, but for producers who grow under protected systems, macro-tunnels, similar to those used in Mexico, have become the preferred option over greenhouses, the latter also accounting for a portion of production.

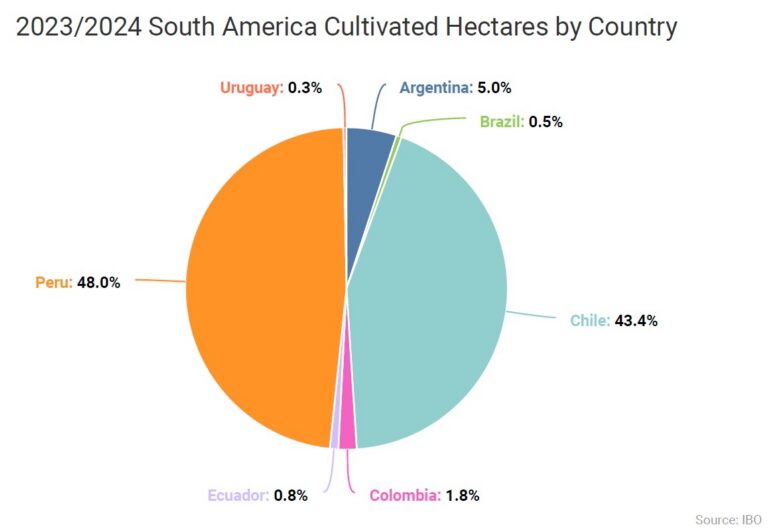

The remaining plantations are concentrated in Antioquia—where a recent census revealed a smaller area than previously estimated—and in the south of the country, near the border with Ecuador. The area planted with blueberries in Colombia has increased tenfold since 2016, placing Colombia above Uruguay, the long-standing South American producer in terms of the industry, although still far behind Argentina.

There are an estimated 600 producers in the country, but only three have farms larger than 20 hectares. The largest of these is a Colombian producer who has accounted for the majority of a fledgling export program focused primarily on the United States.

New plantations driven by domestic and foreign investors are planned for the next two years. Among them is a joint venture with proprietary Australian varieties that hopes to reach 50 hectares in two to three years, in addition to various projects backed by U.S. and Chilean investment capital.

With the expansion of cultivated area and greater investment in varietal quality, the Colombian blueberry industry could experience a significant rebound in the coming years, consolidating itself as a reliable alternative for strategic markets such as the United States, Europe, and Asia.

09-22-2025

Source: Blueberriesconsulting.com