Charting Growth and Navigating Challenges in Zimbabwe’s Blueberry Sector

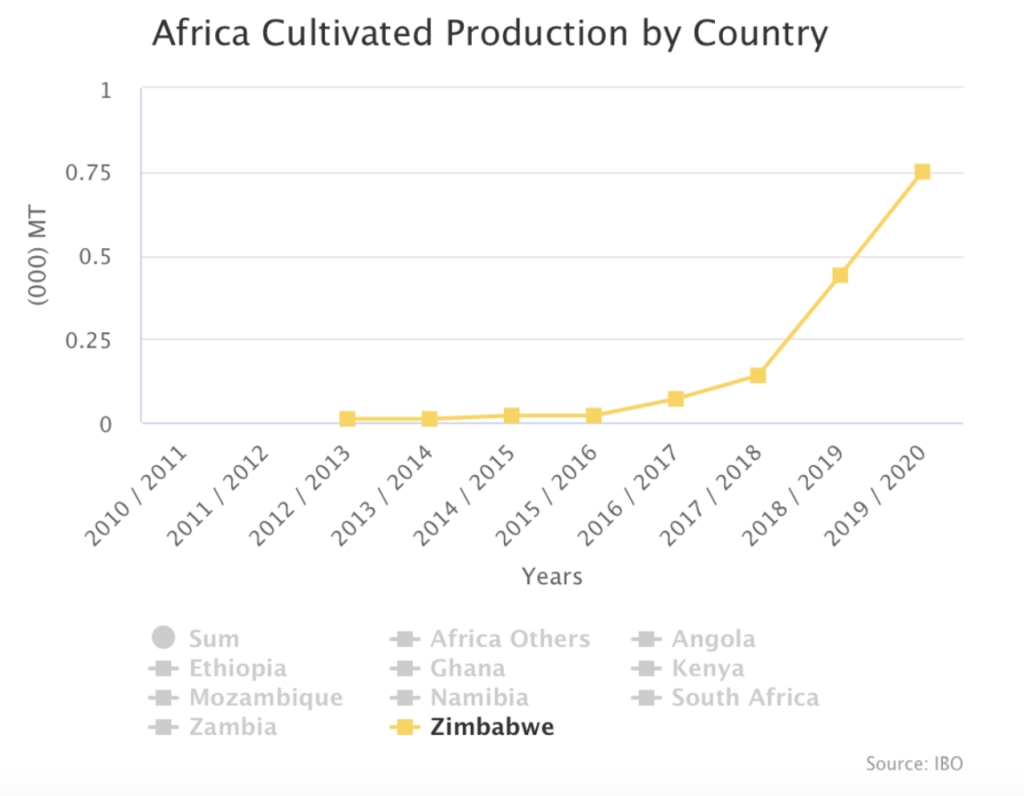

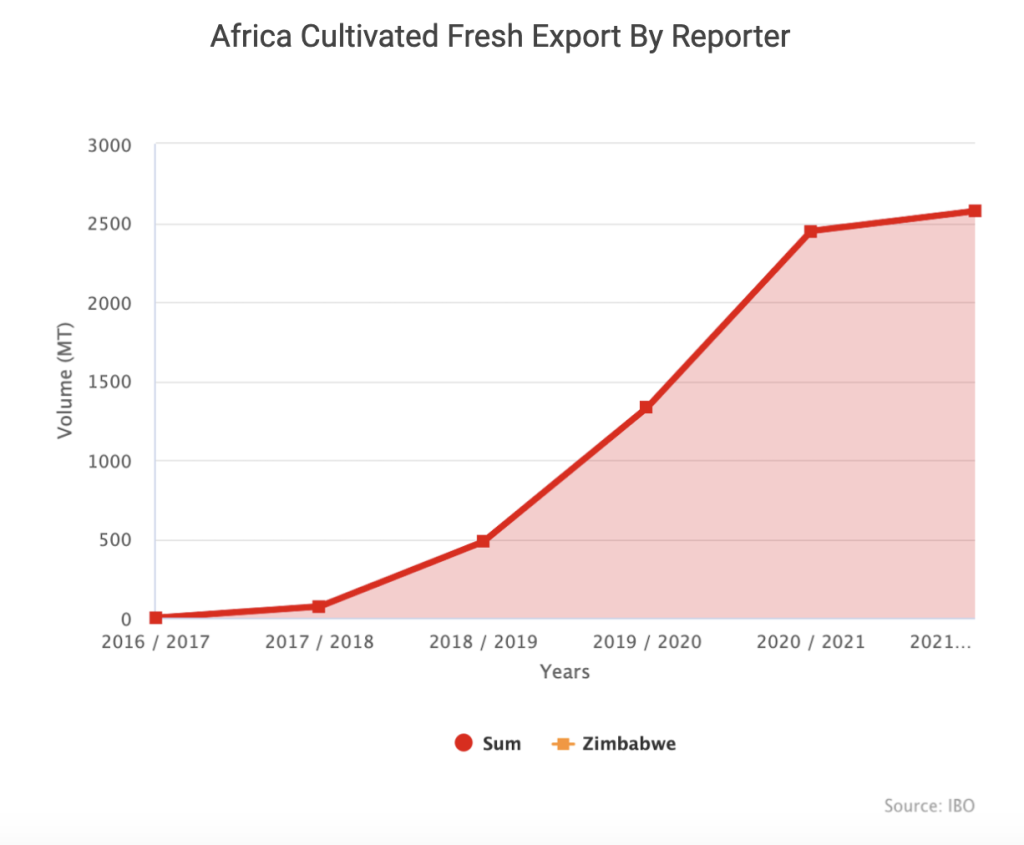

Zimbabwe’s blueberry industry has experienced remarkable growth in a relatively short period. Starting from virtually non-existent farming in 2016, the sector has expanded rapidly, with 570 hectares dedicated to blueberry cultivation by 2021, yielding between 6,500 and 7,000 tons. This growth trajectory has positioned Zimbabwe as the fastest-growing blueberry sector globally in terms of exports and cultivated area. Over the past five years, Zimbabwe has been experiencing an annual increase of 63% in its blueberry exports. In 2022, the country’s exports surged by 2.3 thousand tons, propelling it into the ranks of the top 15 countries in this sector.

Investment in Zimbabwe’s blueberry industry predominantly comes from South African companies and farmers, leveraging their experience in similar enterprises. Additionally, international companies drawn by favorable climatic conditions and soil quality, have established contract farming arrangements with local farmers. Zimbabwe’s blueberries ripen earlier than those of major producers like South Africa, extending the local harvesting season by three weeks, thereby providing a competitive advantage in the global market.

“We possess a climate uniquely suited for blueberry cultivation, particularly during opportune price windows when competition is minimal. Our dry winters, the primary harvesting period, significantly contribute to the impeccable quality of our yield. Furthermore, Zimbabwe benefits from abundant natural resources, including ample sunlight and water, coupled with a skilled and industrious labor force. Cultivating blueberries aligns with multiple objectives – promoting health, generating employment, and optimizing land utilization compared to traditional crops like tobacco or row crops. We believe that blueberry cultivation will revive Zimbabwe’s agriculture to the levels seen in the mid-90s, ” says an industry source.

Despite its rapid growth, Zimbabwe’s blueberry industry faces significant challenges that could hinder further expansion. High interest rates and limited access to long-term financing pose obstacles to farmers, particularly as cultivated blueberries entail substantial establishment costs. Additionally, the volatile economic climate and currency crisis have exacerbated borrowing difficulties, with farmers receiving only a portion of their export earnings in foreign currency.

“Weather plays a significant role since we operate entirely in open fields, leaving us vulnerable to its unpredictability. Frost during early winter can result in yield losses, while hail poses a risk later in the season, typically in September or October, as we saw in the 2023 season. However, we view this venture as a long-term commitment, understanding that there will be both good and bad seasons. It’s essential to weather the tough times and capitalize on the favorable ones. In the early season, we supply South Africa, while during the peak of our season, we focus on the UK, supplying major supermarkets there. Additionally, we export to various European countries such as the Netherlands, Spain, France, and Germany, supplying major retailers across Europe. Approximately 5% of our exports go to the Far East and the Middle East, including Singapore, Malaysia, and Saudi Arabia. We are also working on securing a trade agreement to export to China from Zimbabwe. In terms of competition, we compete mainly with the Northern Hemisphere during their late crop, which coincides with our early crop. Conversely, our late crop aligns with the early crops of South Africa and Peru. However, during our peak season, there’s minimal competition in the market as our blueberries meet high-quality standards, driving growth in the Zimbabwe blueberry industry, ” says an industry source.

“We’re witnessing a rising demand for blueberries, especially in emerging markets, particularly in the East. So, the trajectory of demand will likely impact pricing, which will, in turn, encourage the continued production and export of blueberries,” says an industry source.

Policy issues such as high land levies, import duties on key inputs, and income tax burdens further impede industry growth. Without addressing these challenges, the promising blueberry sector risks stagnation, hindering Zimbabwe’s opportunity to establish itself as a leader in the global market.

To unlock Zimbabwe’s blueberry industry’s potential, strategic interventions are crucial, drawing from successful cases like Peru. These include prioritizing research and development for crop improvement, introducing wild blueberries to diversify production, and enhancing infrastructure along highways for cultivation. Expanding trade agreements, providing financial support, and ensuring macroeconomic stability are also vital for growth. These measures aim to boost competitiveness, expand market access, attract investment, and create a conducive business environment for sustainable industry development. With concerted efforts from government, private sector stakeholders, and international partners, Zimbabwe’s blueberry industry can realize its full potential, contributing to economic growth and job creation in the country.

29/03/2023

By Agronometrics