A New High for Chinese Consumer Blueberry Awareness Amid ASOEX Campaign

The awareness rate of blueberries among Chinese consumers has hit an all-time high of 71% led by strong growth in awareness in third-tier cities, according to recent survey data from global market research firm Nielson. This survey finding was shared by representatives of the Chilean Blueberry Committee of the Chilean Fruit Exporters Association (ASOEX) during a March 5 online seminar entitled “End of 2020–2021 Chilean Blueberry Season Summary.”

The seminar was delivered to members of Produce Report’s WeChat community by ASOEX’s Charif Christian Carvajal, marketing director for Europe and Asia, and Freya Huang, China marketing coordinator.

“Nielson has been tracking and analyzing consumer awareness and market performance for blueberries in China for the past six years,” said Huang during her presentation. “In January, Nielson released the results of its latest survey of 3,010 consumers in Tier 1, 2 and 3 cities. These data revealed that blueberry awareness among Chinese consumers has reached a new high of 71%. The increased awareness was more pronounced in third-tier cities, where the rate grew to 66%, a 15% increase from the previous year.”

Blueberries, raspberries and blackberries were a rare sight in China just a few decades ago. But berry consumption has risen dramatically in recent years alongside increased consumer spending power and greater awareness of their nutritional properties.

The Chilean Blueberry Committee has been one of the more active parties in stimulating blueberry consumption in China through its annual promotional campaigns. Chilean blueberries are available in China from September through early March, with volumes peaking in late January or early February during the leadup to the Chinese New Year holiday.

One of the cornerstone activities of this year’s Chilean blueberry campaign in China was a cross-promotion with the restaurant chain Element Fresh, which focuses on fresh and healthy fusion cuisine. The promotion ran at 37 stores in seven cities as well as being featured on Element Fresh’s social media channels.

During the 2021 season, Chilean blueberries were also promoted in China by over 30 different key opinion leaders on popular social media platforms such as Red, WeChat and Weibo. The Chilean blueberry season was furthermore covered extensively by various mainstream media outlets as well as fruit industry trade media outlets.

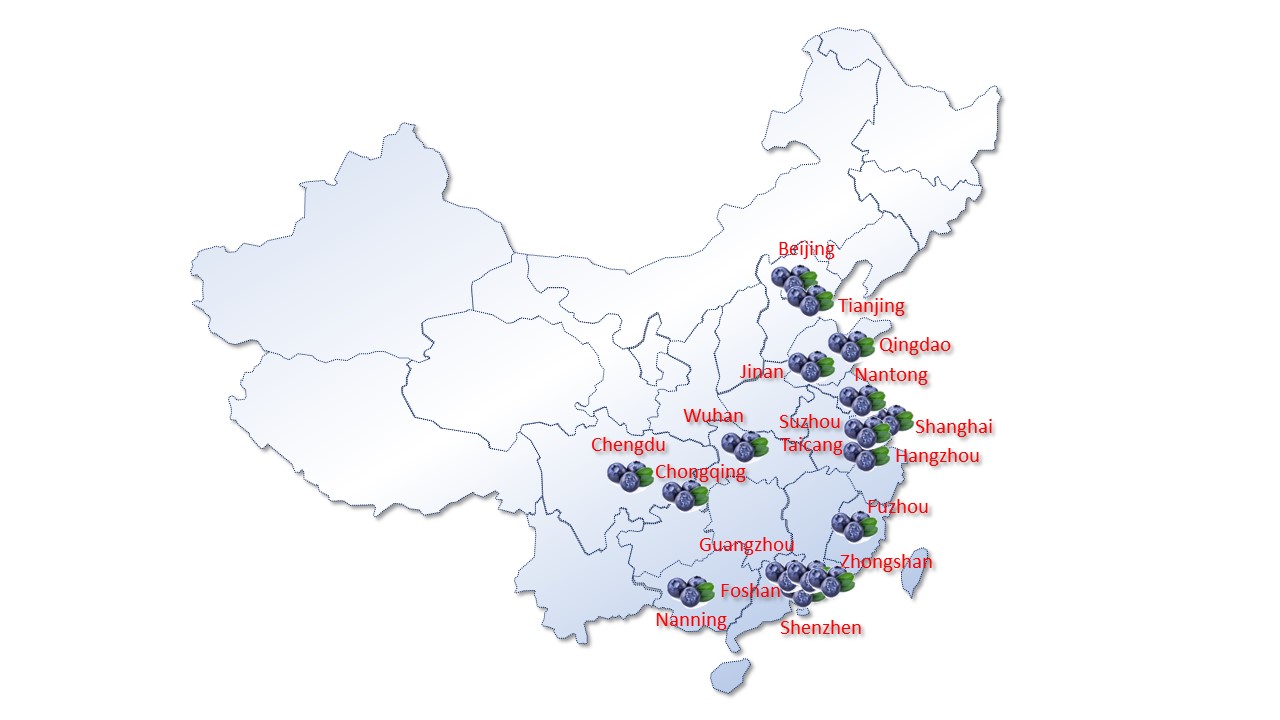

In terms of offline promotion, the Chilean Blueberry Committee this season partnered with major retailers including CenturyMart, Hema, 7Fresh, Ole, Sam’s Club and Walmart to run in-store sessions at 45 stores covering 18 cities. The committee also held a series of events and workshops at wholesale fruit markets in Jiaxing, Zhengzhou, Chongqing and Changsha.

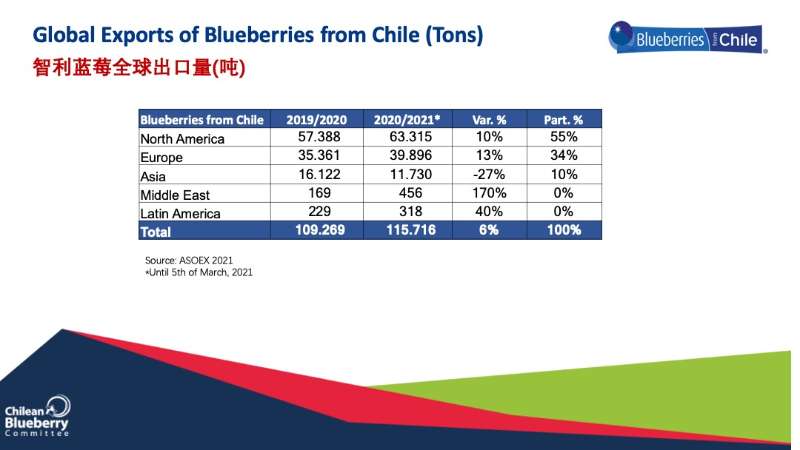

Overall, as of March 5, Chile’s global blueberry exports for the 2020/21 season were expected to see a year-on-year rise of approximately 6%, according to data shared by ASOEX during the seminar. Through week 7, Chile’s total blueberry exports stood at 115,716 tons, compared with 109,269 tons last season.

The overall rise in Chilean fresh blueberry exports to the world is attributable to strong growth in exports to North America and Europe. Export volumes to Asia, on the other hand, dropped by 27% compared with last year, led by a 46% drop in export volumes to China.

“Last season there was a lot of Chilean blueberry volume coming into the marketplace in China and we saw relatively low prices in the market as well as low rotation,” said Carvajal. “This year, between the exporters and the importers they decided to be a little more cautious in terms of sending product to China, and that translated to a better season in terms of price and product movement.”

Even with the course correction in terms of volumes this year, the Chilean Blueberry Committee remains optimistic about the long-term growth prospects for Chilean blueberries in China.

“Whether it’s blueberries from Chile or other origins, at the end of the day, we all have the same objective of increasing the consumption of imported of blueberries during the Chilean season,” said Carvajal. “Today the level of consumption is relatively low per capita in China. What we need to do is increase consumption more amongst Chinese consumers. We are very happy with the information that we’ve seen published by Nielsen showing awareness of Chilean blueberries and blueberries in general is increasing in China — but we still have a lot of opportunities to grow in second-, third- and possibly even fourth-tier cities.”

11/03/2021