Fresh Blueberry Supplies Expand as U.S. Consumers Develop a Taste for Year-Round Blueberries

Blueberries are the second-most produced berries in the United States, after strawberries. Over the past 10 years, the total supply of fresh blueberries available for American consumption has increased fivefold. Availability of fresh blueberries to U.S. consumers has grown at a faster pace than that of fresh strawberries over that same time. U.S. production and imports of blueberries both have been increasing rapidly to meet year-round consumer demand.

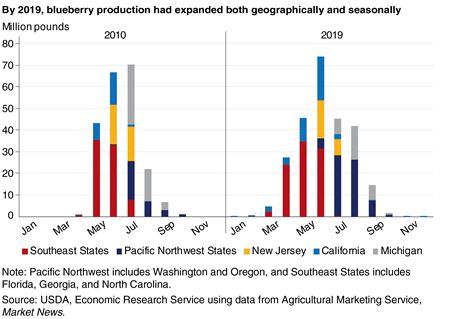

In 2010, New Jersey, Georgia, and Michigan were the biggest U.S. producers of fresh-market blueberries — blueberries that are not directed to the processed market. California, Washington, and Florida were smaller producers. By 2019, the U.S. blueberry sector had expanded as Georgia, California, and Oregon emerged as the largest suppliers, each accounting for roughly 17 percent of U.S. production. USDA’s Agricultural Marketing Service reported fresh-market blueberry shipments from eight States in 2019: California, Florida, Georgia, Michigan, New Jersey, North Carolina, Oregon, and Washington.

Since 2010, the U.S. blueberry production season has expanded into the spring and late summer/early fall months (see figure above). The Florida crop now typically arrives on the market beginning in March and ending in May. Georgia enters the market in mid- to late April, followed by other major producing States, which come into production through the summer. Since 2010, growers in Florida and Georgia have advanced their season using newer cultivars. In eastern Washington, dry growing conditions and relatively little pest pressure have led to the growth in blueberry production there as well as an extended early season. While the harvest ends in September for growers throughout the United States (except in California, which ships small amounts throughout the year), Washington, Michigan, and Oregon ship into October with the use of controlled atmosphere storage.

Despite seasonal expansion of domestic production, U.S. blueberry supplies remain lower from fall to early spring. Consumer demand for year-round blueberries has encouraged all who can increase production in those months to do so. Production overseas has correspondingly expanded in response.

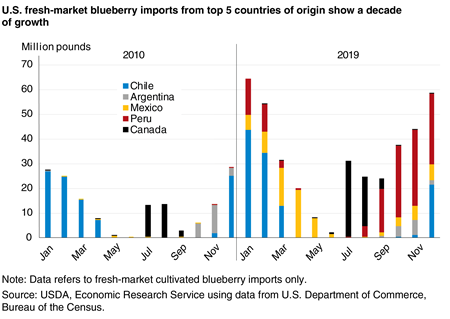

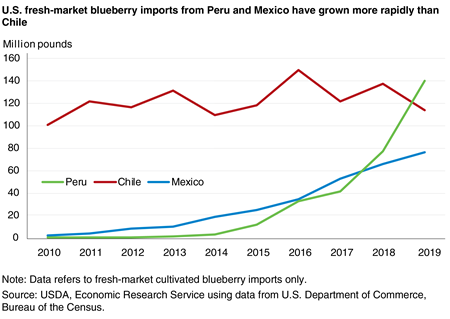

U.S. fresh blueberry imports grew rapidly over the past decade; on average, the U.S. imported 60 percent of blueberries consumed during 2017-19, up from an average of 50 percent from 2010-12. In 2010, Chile was the main foreign supplier of fresh-market blueberries to the United States, and Peru and Mexico produced much smaller quantities of blueberries.

By 2019, however, Mexico and Peru began increasing their share of the U.S. blueberry import market. For instance, Peru’s blueberry exports have grown exponentially in the last decade: by 2019, Peru had become the leading supplier of U.S. blueberry imports. About 80 percent of U.S. blueberry imports in 2019 were sourced from three countries: Peru, Chile, and Mexico (see figure below). The boost in imports from these countries is a likely result of increased cultivation of newer varieties and expanded acreage devoted to blueberries in relatively new producers of blueberries, such as Peru and Mexico.

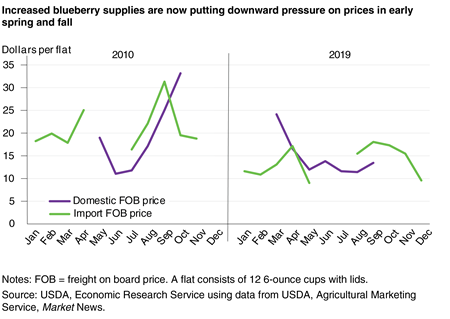

In 2010, there was little overlap in U.S. and foreign blueberry supplies in the domestic market, and the periods between seasons had higher grower prices. Since 2010, domestic and foreign blueberry seasons have extended. Imports from Mexico in early spring have grown, somewhat offsetting imports from Chile, while Florida and Georgia now harvest more in March and April. About 70 percent of import shipments in September and October 2019 were from Peru, increasing competition for producers in Michigan, Washington, and Oregon, where shipments continue until October.

This increase in U.S. production and imports has led to an increase of blueberry supplies in the domestic market, and prices in the U.S. off-season are now lower (see below figure). Correspondingly, the overall price level in 2019 was lower, with smaller price increases in the early spring and fall months. Lower prices that occur as domestic supplies increase are ultimately benefitting U.S. consumers.