Australia: Costa Group joins forces with Macquarie for ag investments

At an Annual General Meeting (AGM) where Costa Group (ASX: CGC) CEO Harry Debney gave an upgraded profit guidance for FY17, the executive also announced a new deal with a leading agricultural investment group.

At an Annual General Meeting (AGM) where Costa Group (ASX: CGC) CEO Harry Debney gave an upgraded profit guidance for FY17, the executive also announced a new deal with a leading agricultural investment group.

At the meeting on Nov. 17, Debney said Costa had entered an exclusive non-binding arrangement with Macquarie Agricultural Funds Management Limited to “jointly investigate compelling M&A [merger and acquisition] projects in farmland, biological assets, water and infrastructure assets”.

“This will extend our capacity to gain significant economic benefit for our shareholders,” Debney said.

But while the company is advancing in some areas, it has retreated from others, with Debney announcing a winding down of Polar Fresh operations.

“This is a joint venture between Costa and Swire Cold Storage which provides management services to a number of distribution centres for the Coles Group,” he said.

“Costa has been reviewing this venture for some time given that the profit stream is not a material value to us particularly in relation to the effort expended in providing the service, and lacks significant synergies with the strategic direction of the company.

“Coles has decided to take one of the three sites in house and Polar Fresh is assisting in the hand over.”

Costa has a carrying value for its share of the Polar Fresh JV of AUD$7.4 million, which will be written off in the FY17 accounts as a non-cash item.

FY17 off to a good start

Debney said the current financial year has started positively, without experiencing any adverse weather events.

“In particular we have not been impacted by flooding events and storms that have affected large parts of the country in recent times,” he said.

“Citrus has been a strong performer, but the season has finished earlier due to the lighter crop as previously flagged. Tomato market pricing has generally been in line with expectations.

“We expect our earnings to be weighted toward the second half of the financial year due to the seasonal timing of international operations and our growth initiatives.”

Due to a “favourable operating environment” for the four months of FY17, the company has upgraded net profit after tax guidance by 15%, inclusive of China start-up expenses.

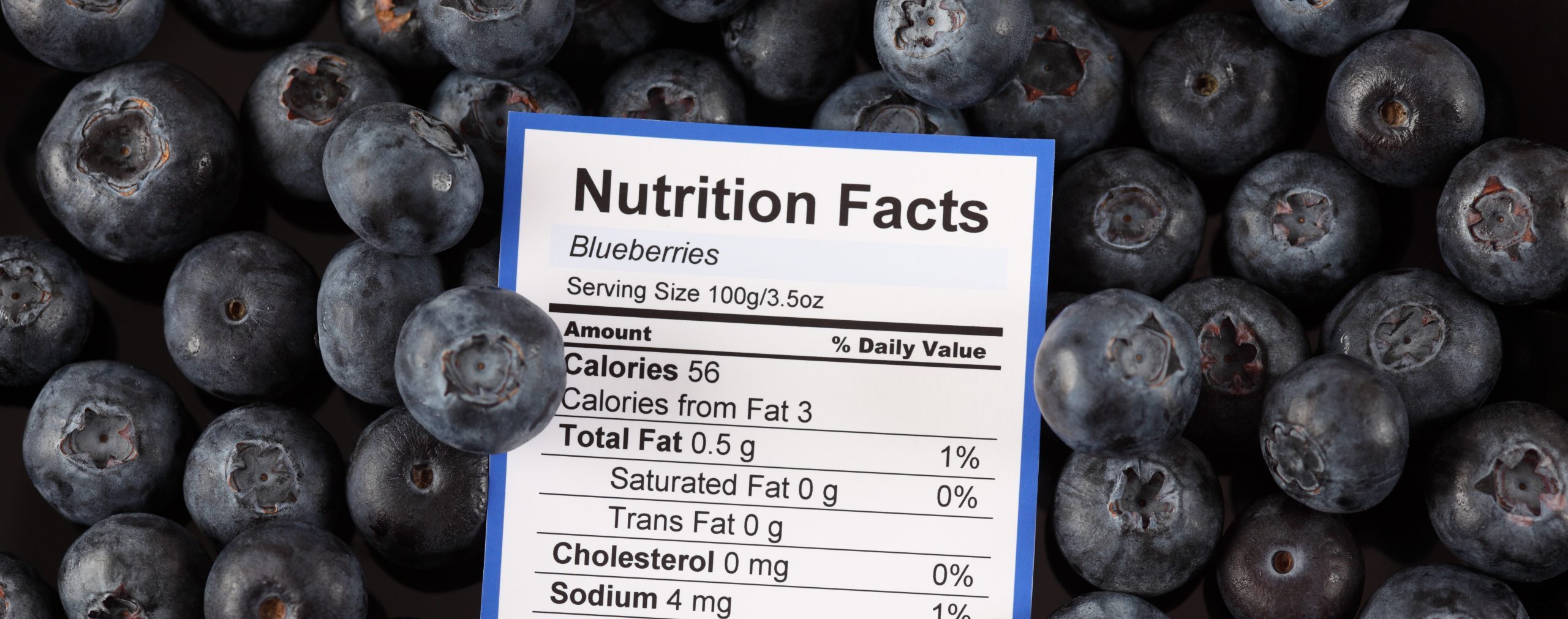

In addition to its Australian production, which also includes a strong focus on mushrooms and berries, Costa Group has berry-oriented joint ventures in North Africa and China, while also licensing its varieties worldwide with Driscoll’s.

At the end of FY16 the group’s African Blue project in Morocco had 208 hectares planted across five farms, including 13 hectares of substrate production.

“Preparation of the recently acquired expansion land is well in hand with 66 hectares of new crop to be planted in calendar 2017,” Debney said.

“New Costa trial varieties are also being tested in Morocco, with the joint venture continuing to self-fund its growth in addition to payment of dividends to shareholders.

He highlighted the China joint berry farm completed its first raspberry harvest in early 2016, and the first blueberry harvest was due to occur in December to April FY17.

“Response to date from the market, while admittedly based on small volumes, has been extremely positive,” he said, also mentioning a second farm in China for blueberries and raspberries was being established in Manlai near the Burmese border.

“Our investment in China is a long term proposition requiring effort and patience to establish our footprint not only in China but also the wider Asian marketplace. However, it is clearly one with very large potential.”

He added income from plant sales had also remained strong, with now more than 800 hectares of Costa’s varieties planted in the Driscoll’s program across the Americas.